Average compound interest rate

7 weekly survey of institutions. In simple terms an average rate of change function is a process that calculates the amount of change in one item divided by the corresponding amount of change in another.

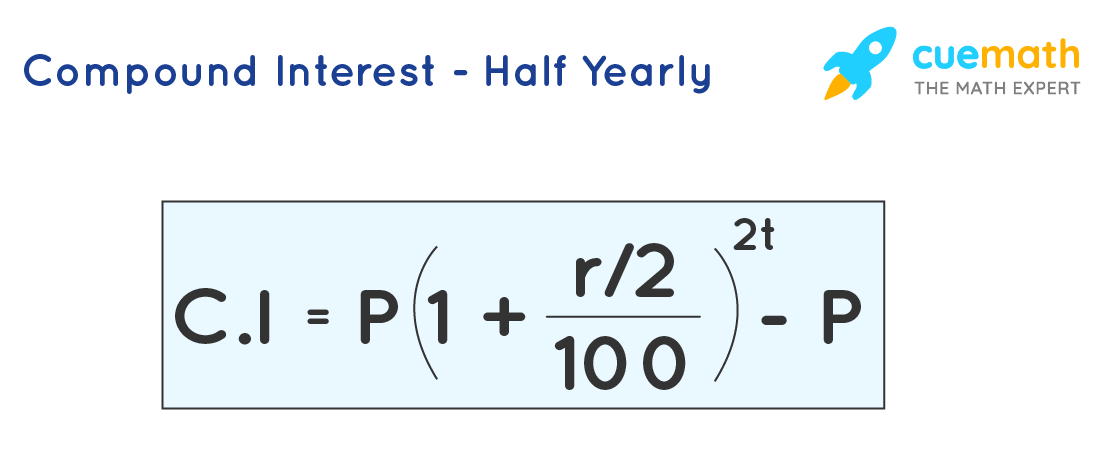

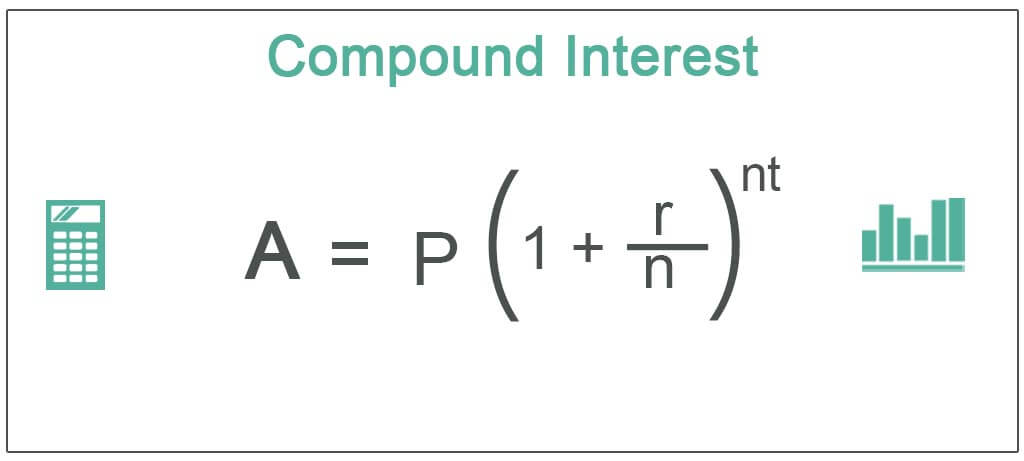

Compound Interest Formulas Derivation Solved Examples

In an account that pays compound interest such as a standard savings account the return gets added to the original principal at the end of every compounding period typically daily or monthly.

. With compound interest investments. Those terms have formal legal definitions in. The interest typically expressed as a.

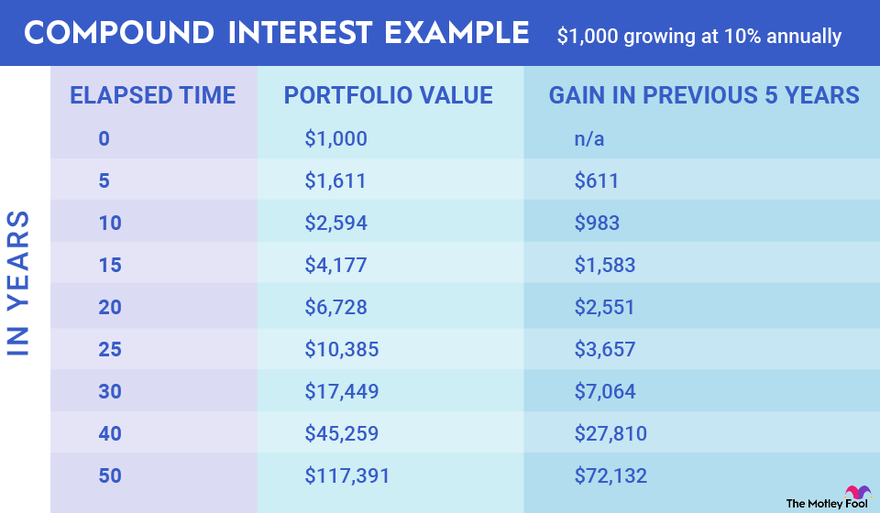

Social Security offers a monthly benefit check to many kinds of recipients. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Student credit cards have the lowest average interest rate among consumer cards at 1993.

10481 1 r. 125 Compounding Annually. Lets say you have 10000 from a lottery and want to invest that to earn more income.

A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts. The national average interest rate for savings accounts is 013 percent according to Bankrates Sept. And if you were being charged 18 compounded daily which is closer to the average credit card interest rate you would pay 5236 in interest after five years.

In July The Balance recorded 181 pricing changes among the offers in its database. Private student loan rates can be lower. As of June 2022 the average check is 154222 according to the Social Security Administration but that amount can.

To compute compound interest we need to follow the below steps. It represents one of the most accurate ways to calculate. Most of the interest-rate moves were hikes of 075 percentage points 144 price changes or 050 percentage-point 22 price changes.

Ln50 004 17329 years to retire at 50 savings rate ln80 004 55786 years to retire at 80 savings rate. You do not need that funds for another 20 years. Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one.

For used cars the average interest rate. Interest is the cost of borrowing money where the borrower pays a fee to the lender for the loan. 617 average starting rate for five-year private student loans with variable rates.

So entering an average number can give you an idea of how much youll earn over. Daily Compound Interest Formula Example 2. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

On average credit cards with a 0 introductory APR on purchases offer around. The SP 500s average rate of return since the 1920s. Average annual rate of return.

Say you have an investment account that increased from 30000 to 33000 over 30 months. The average car loan interest rate was 386 for new cars according to Experians State of the Auto Finance Market report in the fourth quarter 2021. Formula for the Average Rate of Change of a Function.

Compound annual growth rate or CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year. The term annual percentage rate of charge APR corresponding sometimes to a nominal APR and sometimes to an effective APR EAPR is the interest rate for a whole year annualized rather than just a monthly feerate as applied on a loan mortgage loan credit card etcIt is a finance charge expressed as an annual rate. If you plug in 4 youll get numbers close to what you have in the table above.

If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account. Jefferson earned the annual interest rate of 481 which is not a bad rate of return. Regulation Z 12 CFR 102635a2 defines APOR as.

A card with a 0 percent introductory APR period helps reduce your immediate financial burden and gives. Compound Interest Explanation. Using function notation we can define the Average Rate of Change of a function f from a to b as.

At the age of 65 when he retires the fund will grow to 72890 or approximately 73 times the initial investment. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. How to Use the Compound Interest Calculator.

Average prime offer rate means an annual percentage rate that is derived from average interest rates points and other loan pricing terms currently offered to consumers by a representative sample of creditors for mortgage transactions that have low-risk pricing characteristics. Variable rates start at 125 to 225 APR while fixed rates start around 425 to. I think by interest rate on savings he means any investment return not necessarily the interest rate on a savings account in a bank.

Find out the initial principal amount that is required to be invested. The current average interest rate on a credit card is around 18 percent as of September 7th. You approached two banks which gave you different rates.

Thought to have. Many online banks have savings rates higher than the. The formula for calculating average annual interest rate.

Simple Interest vs. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. Annualized Rate 1 ROI over N months 12 N where ROI Return on Investment.

For example if one person borrowed 100 from a bank at a compound interest rate of 10 per year for two years at the end of the first year the interest would amount to. Consumers pay for a variety of different financial productscredit cards included. They wouldnt have been able to multiply at such a rate.

In May 2022 the average credit card. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. The Federal Reserve keeps tabs on the average interest rate that US.

764 average fixed rate for 10-year private student loans.

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

These 3 Charts Show The Amazing Power Of Compound Interest Investing Savings Chart Saving For Retirement

26 Compound Interest Formula Exponential Growth Of Money Part 1 Calculate Compound Interest Youtube

Top 3 Stocks To Buy Other Than Amc Or Gamestop Youtube Compound Interest Interest Calculator Money Management

What Is Compound Interest And How Does It Work For Your Savings Ally

What Is Compound Interest Becu

Daily Compound Interest Formula Calculator Excel Template

Food Science Japan Xylitol Gum Information Sheet From Compound Interest Xylitol Gum Tooth Decay Xylitol

Accounts That Earn Compounding Interest

Compound Interest Definition Formula Calculation Invest

Compound Interest Definition Formulas And Solved Examples

Fidelity Compound Interest

Compound Interest Formulas Derivation Solved Examples

Interest Rate Formula Calculate Interest Rates Interest Rate Chart Math Charts

Compound Interest Definition Formula How It S Calculated